The Minority Business Enterprise (MBE) Certification is a valuable credential that recognizes businesses owned and controlled by minority individuals. This certification opens doors to both corporate and government contracts, boosting visibility and supporting the growth of minority-owned businesses.

To qualify for MBE certification, a business must:

Benefits of MBE Certification

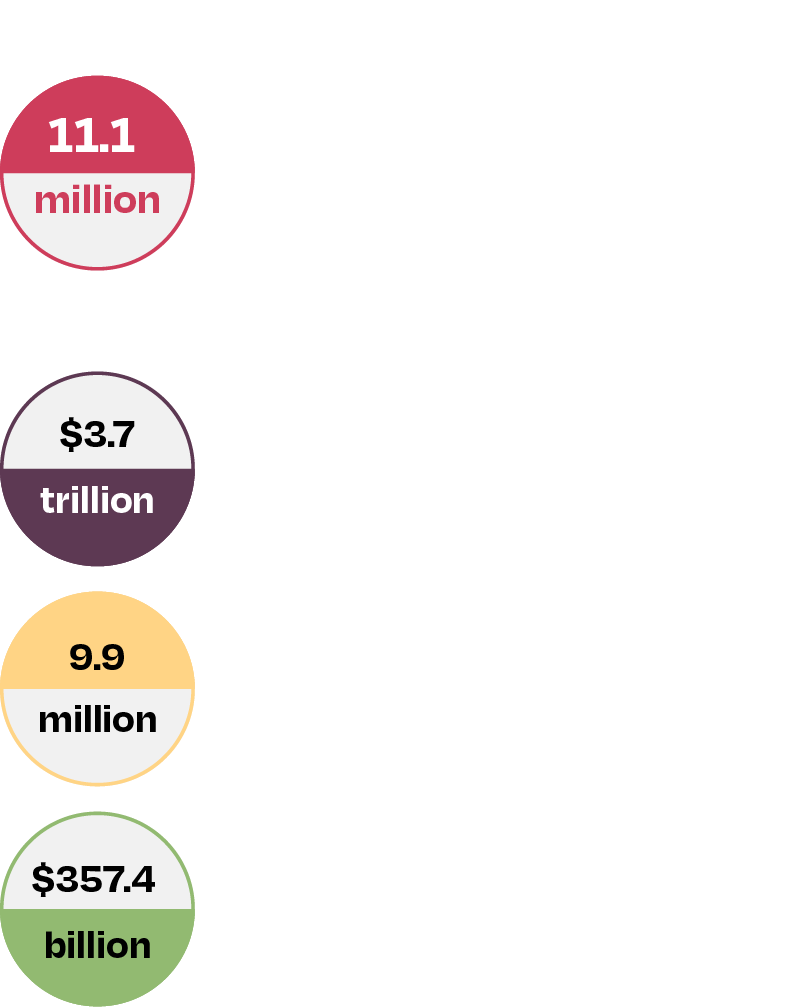

Minority-Owned Businesses in the U.S.

The MBE certification process can be detailed and requires careful preparation. BizPlanEasy helps streamline the process, ensuring your application is thorough and maximizes your chances of approval.

FAQs MBE Certification

Stay Ahead with Easy Business Planning Tips

Join our newsletter to receive expert advice, actionable insights, and the latest trends in business planning. Subscribe now and take the next step toward growing your successful business!